Digital revolution has paved way for financial inclusion in Kenya. This revolution has changed how Kenyans’ access money, borrow money and save/store money. The growth of financial access through technology, Fintech solutions, has provided financial intermediation between many Kenyans were either underserved or unbanked.

This has, in turn, led to the mushrooming of digital lenders and lending platforms, which have dismantled traditional barriers and reduced bureaucratic hurdles that previously hindered Kenyans from accessing credit.

Unfortunately, this ease of access to credit has come with an unbearable burden on borrowers. Kenyans have complained of:

- High default rates among digital credit borrowers, leading to severe implications for negative listings at Credit Reference Bureaus (CRBs);

- Defaults triggering aggressive loan recovery tactics, including calls made to borrowers’ social networks, such as families and friends, for repayment;

- The pricing of loans, particularly the ambiguous application of interest rates and onerous penalty rates that render loans unpayable; and

- Digital lenders serving as obvious avenues for money laundering.

There was therefore need to regulate this sector and a public outcry from Kenyans to be protected from digital lenders who were operating like shylocks.

This led the government to initiate regulatory and supervisory reforms for digital lending, and in 2021, the Central Bank of Kenya (Amendment) Act empowered the Central Bank of Kenya (CBK) to license and oversee digital lenders. The Act refers to digital lenders as Digital Credit Providers (DCPs). Subsequently, in 2022, the CBK issued the Central Bank of Kenya (Digital Credit Providers) Regulations, which required all DCPs to apply to the CBK for a license.

ARE DIGITAL CREDIT PROVIDERS ONLY THOSE WHO LEND DIGITALLY?

Section 2 of the CBK Act states that;

“digital credit” means a credit facility where money is lent or borrowed through a digital channel;

“digital channel” means the internet, mobile devices, computer devices, applications and any other digital systems;

“digital credit business” means the business of providing credit through a digital channel;

“digital credit provider” means a person licensed to carry on digital credit business;

From a literal interpretation of this provisos, it can be easily assumed that any business that does not offer credit through digital channels is not a digital credit provider. The regulations also interchangeably use the word digital channel with the word platform.

This means that any lender who does not have a digital platform where Kenyans can apply for or receive a loan amount may of the considered view that they are not a digital credit provider. This interpretation led to many credit providers who still rely on non-digitized loan application forms and disburse funds through cheques or cash to not apply for the DCP License.

However, the question that begs is whether this literal interpretation aligns with the intention of the legislators when drafting the said provisos and regulations.

REASSESSING CBK’S OVERREACHING INTERPRETATION OF DIGITAL LENDING OVERSIGHT

Despite the literal interpretation that seems obvious from the reading of the legislation, CBK seems to take the mischief rule in interpreting these provisions. The mischief rule of interpretation means that CBK is looking at what the provision and regulation was meant to cure.

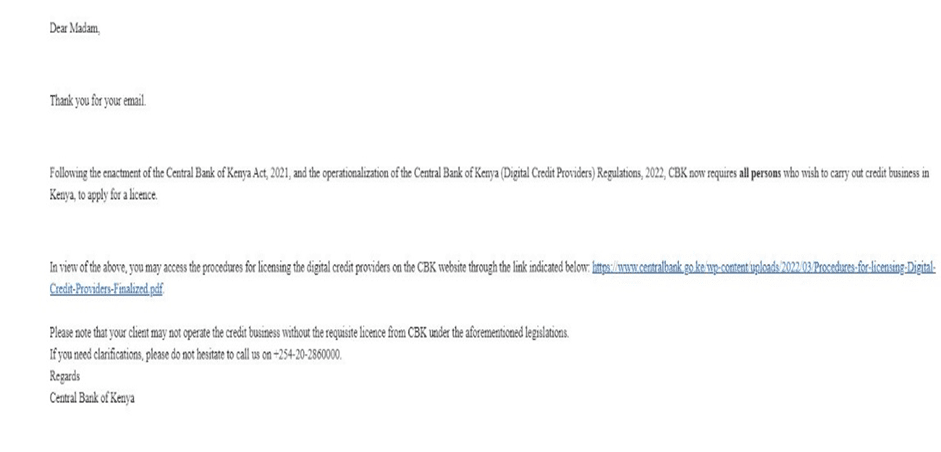

The effect of CBK’s interpretation is to bring every unregulated lender under its purview through licensing, regulation, supervision. Our opinion is based on the communication excerpt below from the Central Bank of Kenya.

We do not agree with this interpretation because it subjects all lenders to CBK supervision, regardless of their debt book, the nature of their lending, and the size of their debt portfolio. However, the Act and the regulations were meant to regulate businesses that lend through digital channels/platforms. While we disagree with this interpretation, the CBK has made it clear that businesses should not offer credit facilities without the required license. This position has not been challenged in court and thus remains the CBK’s stance

In a recent case: Association of Micro-Finance Institutions Kenya (AMFIK)Vs The Central Bank of Kenya & 3 Others in Constitutional Petition E008 of 2022, AMFIK, sought exemption of non-deposit taking microfinance institutions from the DCP Regulations. However, the court dismissed this petition stating that it matters not that the institution offers other services, the only qualification for licensing under the DCP Regulations is for the institution to offer credit through digital channels. It is important to note that the court did not interrogate whether non-digital lending falls under DCP regulations.

Based on the aforementioned case, the court affirmed that the Central Bank of Kenya Act and the Digital Credit Providers (DCP) Regulations apply to all unregulated DCPs, inclusive of non-deposit taking microfinance institutions.

The Central Bank of Kenya’s interpretation of the regulations governing digital credit businesses has been notably broad, leading to an expansive regulatory reach. The CBK maintains that any entity engaged in the provision of credit, regardless of the degree of digital interaction in their lending process, falls within the scope of these regulations. This interpretation implies that all credit providers, even those utilizing traditional lending methods without a digital platform for underwriting or origination, are nonetheless subject to the requirement of obtaining a digital lending license.

Such an all-encompassing approach effectively places the entire credit sector under the CBK’s regulatory umbrella, a stance that extends the original intent of the regulations to cover all forms of lending, despite the absence of digital platforms in some business models. This broad application of the rules suggests that the CBK is positioning itself to regulate the entire credit market, which could have significant implications for lenders who do not primarily operate in digital spheres

CONSEQUENCES OF REGULATIONS OF LENDERS.

As Kenya’s financial sector evolves, the imperative for lenders to comply with the Central Bank’s licensing requirements has become a pivotal element for lawful operation. Failure to adhere to these regulations not only renders all unlicensed lending activities illicit, potentially complicating loan recovery processes, but also exposes lenders to severe penalties.

In addition, the imposition of a 20% excise duty on the interest charged on loans under the new regulation is poised to escalate the cost of credit. This significant financial burden will likely be passed on to borrowers, thus affecting the affordability and accessibility of lending services. Lenders are now faced with a dual challenge: navigating the complexities of obtaining a license, with its associated costs, and contending with the impact of increased taxation on their business model.

This situation leaves the lending industry in a delicate balance—straddling the necessity of compliance to avert legal repercussions and the need to maintain sustainable operations amidst rising costs.